Welcome to the Hallam Jones Autumn Newsletter.

Read about important upcoming tax savings, and learn some great insights and tips from your local financial experts. 😊

Retirement Planning

Retirement planning is a crucial aspect of financial management that often requires careful consideration and strategic decision-making.

As individuals approach retirement age, it becomes imperative to lay down a solid plan that ensures financial security and a comfortable lifestyle during the golden years.

The Smart Move: Reducing Your Life Insurance as You Age

As your priorities and financial responsibilities change with age, reducing your life insurance coverage can be a smart move. It allows you to tailor your policy to your evolving needs, striking a balance between protecting your loved ones and managing your finances effectively.

If you are at a stage in life where you have paid off your mortgage and other debts, it is practical to adjust your policy.

This strategic move demonstrates responsible financial planning, enabling you to enjoy your golden years with confidence and peace of mind.

Mortgage Cashback?

What is a mortgage cashback, why do banks offer it, and what are the pros and cons of accepting it?

A cashback is an agreed amount of money the bank pays homeowners after securing a mortgage. The amount can vary depending on the mortgage size, deposit, loan, affordability, and how you repay your loan.

Banks offer cashback to attract and retain customers, but borrowers need to stay with the lender for at least two years to qualify for the cashback. While cashback can provide a significant amount of money to homeowners, it may not always be the best option, and borrowers should compare the borrowing costs of cashback and non-cashback deals before accepting any mortgage offer.

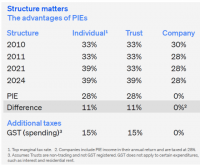

Changes to the Trust Tax Rate

In April 2021, the top personal tax rate for income above $180k was increased to 39%. However, the top trust tax rate remained at 33%. The government of the day highlighted that this variance could cause arbitrage.

Last year, the government announced an increase to 39% effective April 2024 to "plug the tax gap." The current government has indicated that it will proceed with the increase for trusts and will also not lower the top tax rate for individuals this term.

This presents an opportunity for our clients with trusts on the merits of a PIE investment, which offers an 11% tax advantage.

The Rule of 72: A Powerful Tool for Investment

The Rule of 72 is a quick mental math trick that helps you determine the approximate time it takes for an investment to double in value based on a fixed annual rate of return.

To use it, divide 72 by the expected annual rate of return. For example, if you expect a 6% return on your investment, it would take approximately 12 years for your money to double (72 ÷ 6 = 12).

This rule is a handy tool for investors to gauge the potential growth of their investments and make informed decisions about their financial goals. However, it assumes a constant rate of return and doesn't account for factors like inflation or taxes.

Despite its limitations, the Rule of 72 is a valuable starting point for investors looking to set realistic expectations and plan for their financial future. So, next time you're considering an investment opportunity, remember the Rule of 72 to get a quick sense of its growth potential.