Latest News & Updates

Mortgage Cashback?

What is a Mortgage Cashback?

After a mortgage is secured and drawn down, a bank will pay an agreed amount into the borrower's bank account. This sum is known as the 'cashback' and will usually be a percentage of the initial mortgage. Depending on a bank's criteria, cashback offers usually range from 0.10% to 1.00%, or a fixed dollar amount, known as a 'cash incentive', i.e. $3,000 - $7,500, or more, depending on the mortgage size. Having discussed cashback with mortgage brokers working with all major lenders, we understand the 'average' cashback rate offered is around 0.70%.

After the cashback is paid, the homeowner can do whatever they want with it, including making an overpayment on the mortgage (if permitted). However, in most cases, homeowners will use the money to bolster an emergency fund, spend it on property-related expenses, or invest it.

What determines the amount of cashback?

Banks have a standard set of criteria that takes into consideration:

The size of your deposit - the lower the LVR (Loan Value Ratio), the higher the cashback.

The size of your loan - banks like to lend as much as possible, and cashback rates can be used to win customers over.

Your affordability - the bank looks at a borrower's income and overall credit risk; the lower the risk, the higher the cashback.

How you repay your loan - interest-only mortgages usually qualify for low cashback while principal and interest mortgages have higher cashback offers.

Next Steps

Once your loan amount is agreed upon, the cashback is calculated and paid after your mortgage is registered.

As an example, if you've taken out a loan of $500,000 with a 20% deposit, the bank may offer a 0.7% cashback. A payment of $3,500 would be made in the first weeks of your mortgage. This sounds like a lot, but if your mortgage rate is, for example, 3.75% p.a, you're only 'paid back' a fraction of the interest cost you'll pay in the first year ($15,000 in this example).

Know this: Unlike interest and principal payments, which run for the life of the mortgage, your mortgage agreement only pays out your cashback once.

Why do banks offer cashback and cash payment incentives?

Banks use cashback as a marketing strategy to attract and, all going well, retain mortgage clients for years to come. The upfront cost seems generous, but banks don't lose money on such deals - most stipulate that you'll need to stay with the lender for at least two years.

Pro tip: If you're looking to get a mortgage, ask about cashback offers upfront. This shows the broker and/or bank that you're informed and know that they exist. Unfortunately, many borrowers don't know (or don't ask) due to other priorities when buying a home.

Cashback: Must-know conditions and limitations

A cashback is, effectively, 'free money', but it does come with conditions. These vary between banks but generally, you'll need to keep the mortgage for a set period, likely to be two to three years. If you repay your mortgage, sell your home or refinance and change lenders, the bank will usually want the cashback repaid in full (or a portion of it).

To avoid a nasty surprise if your plans change later on, your bank or mortgage broker must explain the terms of a cashback detail. Again, we suggest making sure you fully understand the fine print - having to pay back a cashback is not something anyone wants to do.

Cashback vs No Cashback - How to Easily Compare the Real Cost

An example explains why using a mortgage amortisation calculator is essential:

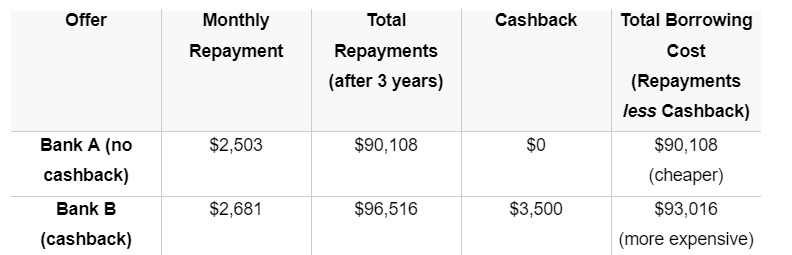

Mike and Aroha are deciding between mortgage offers from two banks for a $500,000 loan.

Bank A offers 3.50% p.a. fixed for three years, while Bank B offers 4.15% p.a. fixed for three years with a 0.70% cashback (meaning a payment of $3,500).

To compare the total costs of borrowing, Mike and Aroha add up the sum of the interest repayments for the three years the mortgage is fixed for.

The results are presented below and show the cashback mortgage with the highest borrowing costs. We have compared the mortgage cost over three years as we assume a borrower would remortgage at the end of the term.

Our view:

Before deciding on a mortgage, we strongly suggest avoiding a cashback temptation and comparing the total borrowing costs for the minimum mortgage term.

Banks offer cashback deals to make buying a home or remortgaging more affordable, and cash-poor customers welcome free money. Overall, we see nothing wrong with such promotions as long as the net cost of all options is available side-by-side.

In most cases, low-rate mortgages always have lower overall borrowing costs than comparatively less competitive cashback mortgage deals.

Pros and Cons of Cashback

Free money from a bank sounds appealing, but a cashback may not always be in your best interests, as we outline below:

Pros:

A significant amount of money coming into your bank account is always going to be useful, even if you allocate it immediately to your mortgage balance.

If you have a large deposit, i.e. 40% or 50%, you are in a strong position to negotiate above the standard cashback rate and bring down the cost of borrowing.

If you secure a market-leading mortgage rate and it comes with cashback, your borrowing costs will be as low as possible.

Cons:

It's not unusual for mortgages offering cashback to have a slightly higher interest rate (given the costs of giving away free money need to be recouped).

You sign a deed of debt that requires you to keep your loan with the bank for a certain period. However, if your circumstances change and you sell your home or repay the mortgage within the cashback repayment period, you will need to repay either the full amount or a portion of it (per the mortgage contract). You'll also need to pay any mortgage break fees (which are calculated and charged separately) on top of the cashback repayment.

If your mortgage is small and/or you have a small deposit, your cashback offer will be correspondingly small.

Whatever you decide to do, we suggest asking these questions before agreeing to any mortgage deal:

- What is the interest rate? Is it competitive with other lenders?

- How much is the cashback? The higher the percentage, the better. If you have a 40% or above deposit, you can better negotiate with a lender for a higher cashback than their standard rate. Make sure you get the dollar number in writing so there's no uncertainty.

- Are you eligible for the cashback? Some small loan sizes may be excluded, and certain banks may prohibit specific borrower types. To compare properly, ensure you know exactly how much is being offered and when it will be paid.

- How long is the minimum term of the mortgage to avoid cashback repayment? Knowing how long you're 'bonded' to the lender is important. While few New Zealanders switch mortgages within the fixed-term period, you may need to repay the cashback if you move home within your fixed term.

- How flexible is the loan if you want to make overpayments? Is there an overpayment fee if you want to apply your cashback to your mortgage balance?

Other Bank Incentives

Sometimes banks don't market cashback as 'cashback' but instead use terms like cash contribution, cash rewards, cash, cash incentive or first home bonus.

Want to find out more? Simply give Michael a call on 021 954 021 or send him a message

This content has been provided for information purposes only and is not intended as a substitute for specific professional advice on investments, financial planning or any other matter. Read our disclaimer notice and privacy statement